Mauritius is a small island nation off the southeast coast of the African continent and east of Madagascar. It is known as a paradise island and is the idyllic place that many ex-pats choose to make their home or their summer home.

The island was colonized by both the British and the French, which can be seen in the country’s architecture and history. It is also a growing country with a booming economy, and a lot of international companies have set up their roots here. So, without further ado, let’s dive into this blog and learn more about investing in a summer home in Mauritius.

1. Quality tourism

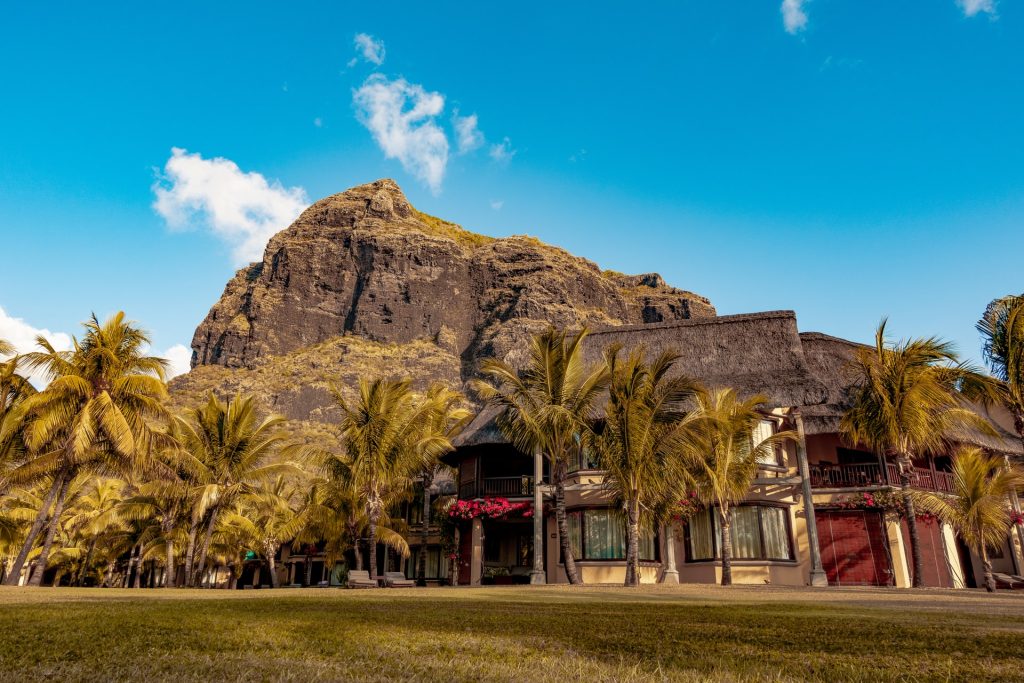

The island offers two UNESCO World Heritage Sites: Morne Brabant and Aapravasi Ghat. Morne Brabant is located southwest of the island, in the Black River district. This basaltic uplift situated at the tip of the land is a place of memory of the island’s colonial past. Many black-maroon and enslaved people found refuge there after their escape until the abolition of slavery in 1835. Today, Le Morne is a major tourist attraction on the island, especially for the lagoon in which it is bathed.

The Aapravasi Ghat is located in the northwest of the island, in the province of Port Louis. Its name means “temporary shelter for those who came from afar”. It is the port of arrival of immigrant labor from India and Sri Lanka, who came to work in the sugar cane fields between 1835 and 1910.

Mauritius is also a hiker’s paradise. The walk allows you to go inland and discover the Chamarel waterfall. Located in the heart of the rainforest, in the southwest of the island, and accessible through the “seven waterfalls” trail, this site gives you access to an incomparable view of the island. Swimmers can also enjoy the lagoon at the foot of the waterfall.

The island is also home to the oldest botanical garden in the world: the Grapefruit Garden, located in the province of the same name.

2. Tropical climate

Off the coast of the Indian Ocean, it never gets below 18°C on Mauritius. The southern summer takes place from November to April, while the southern winter runs from May to October. The Mauritian summer is a hot and humid season. Temperatures range from 28 to 35°C, and rainfall varies from 10 to 20 days at the highest. The Mauritian winter is defined by average temperatures between 18 and 25°C and a maximum of 9 days of rain per month.

Mauritius, as a destination, is a small island that presents notable variations in climate. Thus, the northern and western coasts are warmer, while the southern and eastern coasts are windier. This causes temperatures to drop by up to 20°C, even during the summer. Finally, the center of the island is the region that receives the most rainfall. This particular climate allows lush vegetation to flourish.

The beaches of Mauritius benefit from the protection of the coral reef that surrounds them. The land is thus bathed in turquoise water with an average temperature of 26°C. This natural protection associated with the fact that man settled on the island only in 1507 has allowed the development of rich fauna and flora.

Mauritius is today the center of attention concerning the maintenance of the threatened species, particularly the birds. Everyone has in mind the one that represents the island and its wealth, the dodo, extinct since the end of the seventeenth century.

3. Advantageous tax system

If the living environment makes you dream and has already seduced many Foreign families, the tax advantages applied on the island are strong arguments in favor of real estate acquisition in Mauritius. A single tax of 15% applies to companies and income, regardless of their source.

You also benefit from the absence of:

- Of housing tax

- property tax

- inheritance tax.

As a tax resident, you are exempt from real estate wealth tax (if the beneficiaries are tax residents in Mauritius or, depending on the company’s set-up purchasing the property). In any case, it is always advisable to consult a tax lawyer), even in the case of dividends or capital gains realized on the resale of your property.

Finally, the political stability makes the island a privileged place for the development of the real estate market and a coveted place to live. You, too, can become a permanent resident by investing a minimum of 375,000 dollars.

Being a tax resident means living more than 6 months and one day on the island and having your main residence in Mauritius and no longer in your country of origin.

This right extends to your spouse within the framework of marriage and to your children under 24 years old. If you invest less than 375 000 dollars, you remain dependent on the tax system of your country of origin but can reside on the island for up to six months in the year.

Sound off in the comments section below and tell us if you want to invest in a summer home in Mauritius.